Nasdaq Falls 10% from Record High, Confirming Big Tech Correction

In a striking turn of occasions, the Nasdaq Composite file has tumbled into rectification region, falling 10% from its record tall set fair many weeks prior. This decrease, driven by a blend of baffling profit from major tech monsters and concerns approximately the U.S. economy, has stamped a critical move in showcase opinion, underscoring the challenges confronting the tech division and the broader stock advertise.

A Sobering Reality for Tech Stocks

On Friday, the Nasdaq Composite fell 2.4%, closing at 16,713.15, and amplifying its later slide. This drop brings the record 10.2low its crest of 18,647.45, to on July 10, authoritatively setting it in the adjustment domain. An advertise redress is characterized as a drop of 10% or more from its most later top, reflecting broad speculator cynicism and a move in advertising flow.

The most recent decay takes after a softer-than-expected employment report that has impelled concerns approximately the U.S. economy’s well-being. The Labor Office detailed an increment of fair 114,000 nonfarm payrolls in July, falling brief of economists’ desires of 175,000. The unemployment rate moreover climbed to 4.3%, nearing a three-year tall. This baffling information has raised fears that the Government Save may have to execute critical intrigue rate cuts to fight off a potential recession and advance unsettling financial specialists.

Tech Giants Struggle

The Nasdaq’s later troubles have been exacerbated by lackluster profit from key tech players. Amazon (AMZN) and Intel (INTC), two of the biggest components of the file, detailed baffling quarterly comes about, starting a sell-off. Amazon saw its stock dive about 10% after its profit discharge, whereas Intel’s offers plunged more than 25%, reflecting speculator unease around its future development prospects. These difficulties have cast a shadow over the broader tech division, which has been a major driver of the Nasdaq’s picks this year.

The decline in these tech giants underscores a broader issue: the once-unstoppable rally driven by positive thinking around counterfeit insights (AI) and the guarantee of lower intrigued rates shows up to be losing steam. The Nasdaq’s redress may be a stark update that indeed the foremost vigorous bull markets can confront critical headwinds.

Historical Context and Market Outlook

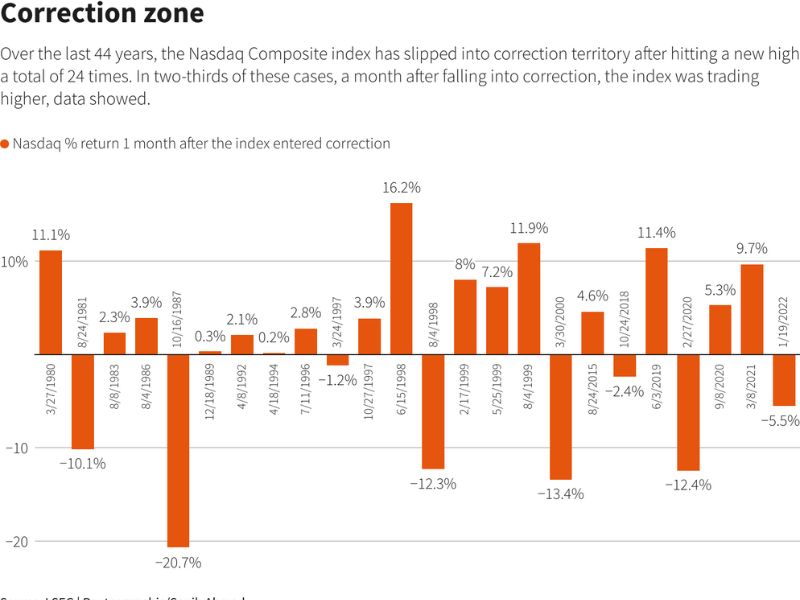

This isn’t the first time the Nasdaq has entered a rectification region after coming to modern highs. Authentic information appears that over the past 44 a long time, the record has slipped into adjustment 24 times after hitting a modern crest. In almost two-thirds of these occasions, the file exchanged higher within a month after the adjustment started, recommending that whereas rectifications can be excruciating, they are frequently taken after periods of recuperation.

The final redress happened on January 19, 2022, when the Nasdaq fell 36% from its tall time recently bottoming out in December. Despite this, the file has bounced back emphatically, reflecting the strength of the tech segment and broader advertising.

Be that as it may, current conditions vary from those past occasions. The later adjustment has been driven by a combination of tall valuations, delicate financial information, and financial specialist concerns almost the maintainability of tech-led picks up. The Nasdaq’s drop comes amid a regularly rough period for stocks, including the instability confronting financial specialists.

Broader Market Impact

The Nasdaq’s decay has also resonated over other major files. The Dow Jones Mechanical Normal fell 910.06 focuses, or 2.26%, whereas the S&P 500 misplaced 130.49 focuses, or 2.40%. Both records are too encountering striking misfortunes, with the S&P 500 hitting its most reduced level since early June. The small-cap Russell 2000 record has drooped almost 4%, stamping its greatest two-day slide since June 2022.

The Philadelphia SE Semiconductor Record, which incorporates numerous chip stocks like Intel, has hit a three-month moo, highlighting the far-reaching effect of the tech sector’s battles. Despite these difficulties, Apple stands out as a relative shinning spot, with its offers rising around 2% taking after solid third-quarter iPhone deals and hopeful figures.

Looking Ahead

As the Nasdaq navigates this rectification, speculators are hooking with the suggestions for broader advertising. Whereas the adjustment may flag a period of instability and caution, history recommends that the showcase frequently recoups from such mishaps. The key will be observing financial markers and corporate profit reports to gauge the direction of both the tech segment and the broader economy.

In conclusion, the Nasdaq’s drop into the redress region serves as an update on the inborn dangers within the tech segment and the broader stock showcase. As speculators process the most recent financial information and corporate profit, the viewpoint for the Nasdaq and other files will depend on how well the economy oversees to climate these challenges and how rapidly the tech division can recapture its balance.

Must Read:

- HDFC Bank vs Kotak Bank Q1 Result Today Update: What to Expect from Their Financial Results

- Infosys Share: Can Infy Deliver TCS, HCL Tech-like Q1 Results Today?

FAQ: Nasdaq Falls 10% from Record High

1. What does it mean when the Nasdaq Composite index falls 10% from its record high?

When the Nasdaq Composite record falls 10% or more from its most later crest, it is considered to be in a advertise adjustment. This decrease reflects a critical drop in financial specialist certainty and can be driven by different components such as baffling financial information, powerless profit reports, or concerns about exaggerated stocks. A rectification could be an ordinary portion of advertising cycles and regularly serves as a period for the advertising to solidify and possibly recuperate.

2. Why did the Nasdaq Composite index experience a correction recently?

The recent correction in the Nasdaq Composite index was triggered by a combination of factors:

- Disappointing Earnings: Major tech companies like Amazon and Intel detailed weaker-than-expected profits, driving a sell-off in their stocks and affecting the by and large file.

- Weak Economic Data: A softer-than-expected employment report raised concerns about the U.S. economy’s well-being, proposing that the Government Save mt cut intrigue rates essentially to maintain a strategic distance from a retreat.

- Valuation Concerns: There are stresses that the tech segment, which has driven much of the Nasdaq’s picks up this year, may be exaggerated, driving to a broader redress.

3. How does a correction in the Nasdaq affect the broader stock market?

A correction in the Nasdaq can impact the broader stock market in several ways:

- Investor Sentiment: A decrease in a major list just like the Nasdaq can affect investor certainty and lead to broader showcase sell-offs, as seen with decreases within the S&P 500 and Dow Jones Mechanical Normal.

- Sector Performance: Since the Nasdaq is intensely weighted with innovation stocks, an adjustment can lead to broader concerns approximately tech segment valuations and impact-related divisions and files.

- Market Trends: Whereas rectifications are frequently taken after by recuperations, they can moreover flag a move in showcase patterns and lead to expanded instability in other segments as financial specialists reassess their portfolios and financial viewpoint.