Won Currency: Navigating South Korea’s Foreign Exchange Challenges and ETF Market Shifts

South Korea’s financial scene is experiencing critical changes, especially in its approach to stabilizing the won money. As the government plans to diminish its outside trade stabilization finance by more than 30% in 2025, questions emerge approximately the suggestions for the won and the broader monetary advertise. This decrease, the biggest since the fund’s initiation in 1967, could be a vital move that reflects the government’s certainty in its capacity to oversee cash instability. But what does this cruel for financial specialists, and how are these shifts playing out within the ETF showcase?

A Record Reduction in the Foreign Exchange Stabilization Fund

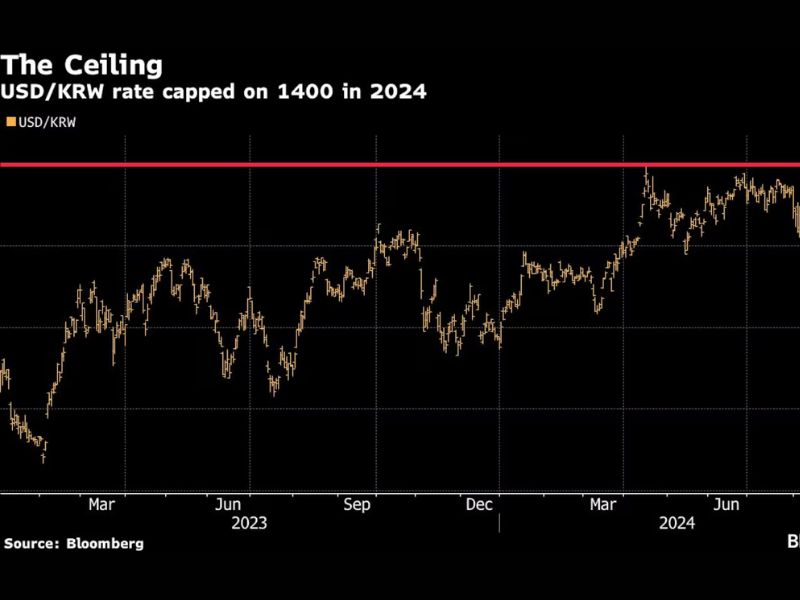

The choice to cut the outside trade stabilization support from 205.1 trillion won to 140.3 trillion won may be a strong one, particularly considering the won’s later battles. The South Korean money has fallen 3.7% against the US dollar year-to-date through Admirable, making it the second-worst entertainer in Asia, trailing as it were the Taiwanese dollar. Despite this, the government guarantees that the diminished support will still be adequate to guard the won.

Hee Jae Kim, executive of the outside trade showcase division of South Korea’s fund service, emphasized that the fund’s current measure is satisfactory to reply to market fluctuations. “A decrease within the measure of the finance does not necessarily infer a diminishment in its capacity to reply to the outside trade showcase,” he expressed in a later meeting. This certainty is supported by the reality that South Korea’s foreign trade saves are more than three times the country’s short-term outside obligation, recommending a vigorous buffer against potential emergencies.

The Won’s Volatility and Its Impact on the ETF Market

The won’s instability has been a noteworthy concern for South Korean specialists this year. The currency’s fluctuations have incited the government to amplify exchange hours and actualize measures to extend the won’s soundness, particularly as South Korea pushes for consideration in more worldwide money-related records.

These cash swings have moreover had a recognizable effect on the ETF showcase. Particularly, currency-hedged ETFs, which secure against trade rate changes, have beaten their currency-exposed partners. As of Admirable 30, the top-performing ETFs following the S&P 500 and NASDAQ 100 files were all currency-hedged. For occurrence, the “TIGER SYNTH-S&P500 Leverage(H)” ETF drove the pack with a month-to-month return of 4.44%, whereas currency-exposed ETFs saw their returns drop by around 1% due to the won’s appreciation.

The Appeal and Costs of Currency-Hedged ETFs

The rising intrigue in currency-hedged ETFs is not astonishing, particularly given the current trade rate environment. With the Korean won anticipated to reinforce against the US dollar, adroit financial specialists have been pouring cash into these items. The “KODEX US S&P500(H)” ETF alone saw an influx of 35.9 billion won in Admirable, speaking to a noteworthy parcel of its add-up to inflows for the year.

In any case, contributing to currency-hedged ETFs isn’t without its downsides. These items bring about extra costs due to the have to keep up a settled trade rate, which can eat into returns over the long term. As a result, whereas currency-hedged ETFs offer security against trade rate instability, they may be less alluring on the off chance that the won proceeds to rise.

What Lies Ahead for the Won and Investors?

The won’s future remains dubious, with the potential for encouraging instability depending on worldwide financial conditions and US Government Save arrangement choices. Presently, currency-hedged ETFs offer a profitable instrument for overseeing hazards in this environment, even though speculators ought to be careful of the related costs.

As South Korea navigates these challenges, the government’s proactive measures and the flexibility of the won will be basic in keeping up monetary soundness. Speculators, in the interim, must weigh the benefits and costs of diverse speculation procedures in this advancing scene.

In conclusion, South Korea’s choice to cut its remote trade stabilization finance may be a calculated hazard that reflects certainty within the won’s strength. For investors, the progressing instability presents both openings and challenges, particularly within the ETF showcase. Continuously, remaining informed and adaptable will be key to exploring the turns and turns of the won cash in the months ahead.

Also Read:

- Thousands Protest in Istanbul Against Controversial Stray Dog Legislation

- Doctor Bailed in Matthew Perry Drug Death Case

FAQs:

1. Why is South Korea cutting its foreign exchange stabilization fund?

South Korea is decreasing its outside trade stabilization finance by over 30% to 140.3 trillion won in 2025. Despite this cut, the government accepts the remaining saves are adequate to oversee cash vacillations and protect the won against intemperate instability.

2. How has the South Korean won performed recently?

The South Korean won has dropped 3.7% against the US dollar year-to-date through Eminent, making it the second-worst entertainer in Asia. The currency’s decay has provoked expanded intrigue in currency-hedged ETFs.

3. What impact does the won’s decline have on ETFs?

The win’s decrease has driven expanded returns for currency-hedged ETFs, which ensure against trade rate changes. In differentiation, currency-exposed ETFs have seen decreased execution. Financial specialists are moving towards currency-hedged alternatives to relieve hazards.