GameStop Shares Double as Gill Post Shows $116 Million Bet

GameStop (NYSE: GME), the notorious meme stock, has experienced another unstable surge in premarket exchanging, driven by a hypothesis encompassing Keith Gill, the man behind the 2021 Brief Crush marvel. Gill, moreover known as “Thundering Kitty” on YouTube and X (once in the past Twitter), and “DeepF——Value” on Reddit, as of late reemerged, possibly holding a noteworthy position in GameStop.

The Resurgence of a Meme Stock Legend

On Sunday night, Gill posted a screenshot on Reddit’s r/SuperStonk gathering, showing what shows up to be his portfolio containing a shocking 5 million offers of GameStop, worth around $115.7 million. In expansion to these common offers, the screenshot uncovered a considerable holding of 120,000 call choices, with a strike cost of $20 each, lapsing on June 21. The entire venture in these choices was generally $65.7 million.

This sudden return has touched off a new wave of excitement among retail dealers, driving an emotional increment in GameStop’s stock cost. By 5:10 a.m. ET on Monday offers had taken off by 73%, taking after a prior spike of 90%. This rally marks a critical turnaround for the stock, which had been mulling since its brilliant rise and drop in early 2021.

A New Rally Begins

Gill’s return to the highlight comes after months of quiet. His past post on Reddit dated back to April 2021, where he unveiled holding 200,000 GameStop offers, esteemed at roughly $30.9 million at that time. His most recent screenshot, in case bona fide, underscores his proceeded conviction within the video amusement retailer’s potential.

The effect of Gill’s post was prompt and significant. GameStop’s stock cost surged over 19% in overnight exchanging, including an evaluated $8 billion to its showcase capitalization. Other meme stocks too profited from the recharged intrigue, with AMC Excitement Property Inc., SunPower Corp., Past Meat Inc., BlackBerry Ltd., and Reddit Inc. all encountering noteworthy premarket picks up.

Social Media Frenzy

On social media stage X, Gill, beneath his “Thundering Kitty” persona, posted a picture of a UNO switch card—a lively however typical motion that proposes an alter in the heading. The post earned around 5.5 million within nine hours of its distribution, encouraging increasing the buzz around GameStop.

Market Analysis and Sentiment

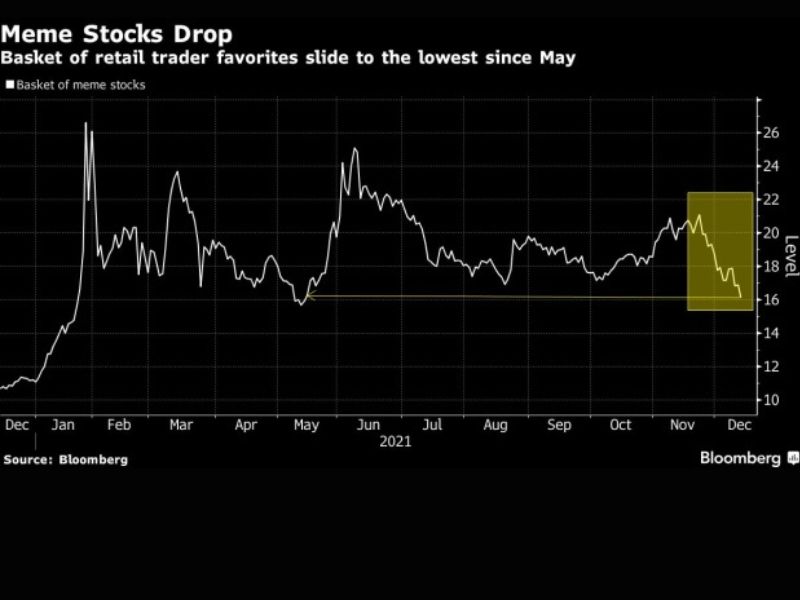

Robert Lea, an examiner at Bloomberg Insights, cautioned that the resurgence in meme stocks may be demonstrative of intemperate advertise richness, particularly as major U.S. files battle to reach new highs. He proposed that the recharged intrigue could be a negative sign in the midst of rising advertise headwinds.

Despite the volatility and theoretical nature of meme stocks, Gill’s impact on the showcase is irrefutable. His promotion for GameStop in 2021 started a retail exchanging craze, driving galactic picks up and bringing the concept of meme stocks into standard awareness.

Looking Ahead

As GameStop’s stock proceeds to encounter wild variances, the broader suggestions for retail dealers and the showcase stay to be seen. Gill’s reentry into the open eye has reignited intrigue and theory, setting the organization for another potential rollercoaster ride for GameStop shareholders.

Presently, the center remains on Keith Gill and his high-stakes wagered on GameStop. Whether this most recent surge will lead to supported development or another sensational crash, one thing is certain: the adventure of GameStop and its energetic community of retail dealers is distant from over.

Click Here To Learn About: